UNIT 2: Circular Flow, GDP, Real GDP, Nominal GDP, Employment, Unemployment, Natural Rate of Unemployment , Inflation Types, CPI and Inflation over time, The GDP Deflator and it uses

January 27, 2016

Circular Flow Diagram:

- It represents the transactions in a economy.

Product Market:

- The place where goods and services are produced by businesses.

Factor Market:

- The place where households sell resources and businesses buy resources.

Firms:

- An organization that produces goods and services for sale.

Household:

- A person or a group of people that share their income.

- They sell the factors of production (land, labor, capital (physical & human), entrepreneurship) to businesses.

January 28, 2016

UNIT 2: GDP, Real GDP, and Nominal GDP

Gross Domestic Product (GDP):

- The total market value of all final goods and services that is produced withing a country's borders in a given year.

- Every country has its own GDP.

Gross National Product (GNP):

- The total market value of all final goods and services by citizens of that country on its land or foreign land.

- Every country has its own GNP.

Included in GDP:

C - Personal Consumption Expenditure (65%)

Ig - Gross Private Domestic Investment (17%)

- New factory equipment

- Factor equipment maintenance

- Construction of housing

- Unsold inventory of products built in a year

G - Government Spending (20%)

Xn - Net Exports (-2%)

- (Exports - Imports)

What's NOT included in GDP:

1.) Intermediate goods

- Goods that require further processing before they are ready for final use.

- Trying to avoid double goods

- It fluctuates, it could crash, it doesn't involve a good or service; not durable.

- EX: Selling drugs

- EX: Unreported tips

- Public: (Social Security, welfare, etc.)

- Private: (Scholarships)

7.) Non-market activities

- Volunteering

- Baby-sitting

- Any work that you perform for yourself

February 1, 2016

2.) Expenditure Approach

UNIT 2: Calculating the GDP: Expenditures and Income Approach

2 Ways To Calculate GDP:

1.) Income Approach

- Add up all the income that resulted from selling all final goods and services produced in a given year.

- Not used so much (people lie about their income)

- Formula: GDP= w + r + i + p + statistical adjustments

2.) Expenditure Approach

- Add up all the spending on final goods and services produced in a given year.

- Formula: GDP= C + Ig + G + Xn

Compensation of Employees:

- Wages and salaries

- Wages and salary supplements (Pensions, health insurance, welfare)

Rents:

- Income received by the households and businesses that supply property resources

- Ex: Tenant to landlords (monthly payments)

Interests:

- Money paid to suppliers of loans

Proprietors Income:

- Comes sole proprietors and partnerships

- Sole Proprietors: you own your business (entrepreneurs)

Corporate Profits:

- Could include dividends, corporate income taxes, undistributed corporate profits

Statistical Adjustments:

- Indirect business taxes

- Consumption of fixed capital (depreciation)

- Net foreign factor payment

Budget:

- Formula: Government purchases of goods & services + Government transfer payments - Government tax and fee collections

- + : deficit

- - : surplus

Trade:

- Formula: exports - imports

- + : surplus- : deficit

National Income:

- Formula:

- 1.) Compensation of employees + rent + interests income + proprietors income + corporate profits

- 2.) GDP - interest business taxes - depreciation - net foreign factor payments

Disposable Personal Income:

- Formula: National income - personal household taxes + government transfer payments

Net Domestic Product (NDP):

- Formula: GDP - depreciation

Net National Product (NNP):

- Formula: GNP - depreciation

- GNP = GDP + net foreign factor payment

February 2, 2016

Transferable Skills:

A person who has a skill set but bad experience.

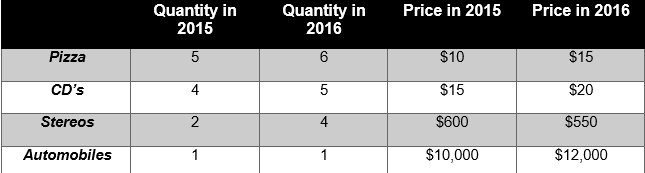

Nominal GDP:

- It is the value of output produced in current year prices

- Formula: Output= Quantity

Real GDP:

- It is the value of output produced in constant base year prices

- Adjusted for inflation

- Real GDP can increase from year to year only if quantity increases (used for economic growth)

- Formula: Price × Quantity

- If you wanted to measure economic growth, use real GDP.

- If you wanted to measure inflation, use nominal GDP.

- In the base years: nominal GDP = real GDP

- In years after the base year, nominal GDP will exceed real GDP.

- In years before the base year, real GDP will exceed nominal GDP.

GDP Deflator:

- In the base year, the GDP deflator equals 100

- For years after the base year, the GDP deflator is greater than 100.

- For years before the base years, the GDP deflator is less than 100.

Consumer Price Index (CPI):

February 3, 2016

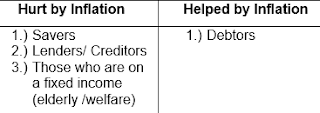

Nominal Interest Rate:

- It is NOT adjusted for inflation but your real interest rate is (anticipated).

- Percentage increase in money you pay the lender for the use of money that you borrowed.

- Formula: Real rate of interest + inflation premium

Real Interest Rate:

- It is adjusted for inflation (unanticipated)

- It is percentage increase in purchasing power the lender receives when the borrower pays the loan with interest

- Formula: Nominal interest rate - inflation = real interest rate

Unanticipated Inflation:

Cost of Living Adjustments (COLA):

- Automatic wage increases when inflation occurs.

February 4, 2016

Unemployment:

- It is failure to use available resources particularly labor to produce desired goods and services.

- Not having a job/working (obviously)

Labor force:

- Anybody above 16 years of age

- Able of willing to work

- Employed + Unemployed

Not in the Labor force:

- People in the military

- Homemakers

- Retired people

- Students (even if they work)

- Disabled people

- People in metal institutions

- People in jail/ prison

- Those who are not looking for work

Unemployed Rate:

- 4% to 5 = Full employment or Natural Rate of Unemployed (NRU)

How to calculate the Unemployment Rate:

Formula:

Transferable Skills:

A person who has a skill set but bad experience.

Types of Unemployment:

Frictional:

Frictional:

- People who are looking for a job

- Temporarily unemployed or between jobs

- Individuals with transferable skills

- Ex: High school or college graduates looking for job

- Ex: Individuals who leave their jobs in hope of finding better

Structural:

- Changes in the structure of the labor force makes some skills obsolete.

- These workers DO NOT have transferable skills

- Have to learn new skills to get job

- Ex: Space people after Obama closes down the space program -> Have to learn new skills to get another different job.

- Ex: VCR's

- Due to the time of the year and the nature of the job.

- Ex: School-bus drivers - only work when school is in

- Ex: Santa Clauses impersonators - only work during Christmas time

- Ex: Lifeguards - only work in the summers

- Ex: Construction workers - only work when there isn't any acclimate weather.

Cyclical:

- Unemployment that results from economics downturns, such as a recession.

- As demand for goods and services falls, demand for labor falls and workers are laid off.

- Ex: Closing of Macy's and Wal-Marts

- Ex: Recession: Oil industry

- Full employment means no cyclical unemployment

- 2 of the 4 Types of Unemployment are unavoidable: Structural & Frictional = (NRU)

February 5, 2016

GDP Gap:

- It is the amount by which actual GDP falls short of potential GDP.

Okun's Law:

- For every 1% in which the actual unemployment rate exceeds the natural rate of unemployed.

- GDP gap of about 2% occurs

- Ex: In 2011, the unemployment rate for Mexico is 7.4%. The NRU is 6%.

7.4 - 6 = 1.4

1.4 × 2= 2.8%

Gap: 2.8%

The Rule of 70:

- It is used to determine how many years it will take for a value to double given a particular annual growth rate

- Ex: If you put $20,000 in the bank and it earns a yearly interest of 7%, how many years will it take for your income to double?

- Formula: 70 ÷ interest rate

- 70 ÷ 7 = 10 years